Crypto Token & D'app

Azima is a cryptocurrency token and decentralised app, centred around P2P transactions. We are a crypto startup that enable P2P trading and crypto loans, enabling the common person to have access to extra banking services without the need of centralized authorities. We created Azima to serve the people, who have lost trust in banks and centralised crypto exchanges after countless scnadals. The Azima ecosystem is built on the Cardano network, who we share a common goal with, of redistributing power from traditional banking systems to the people. We are an early stage start up so sign up to our newsletter to receive the latest news and updates.

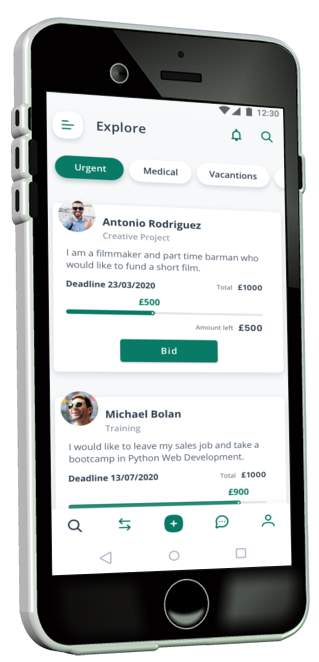

P2P Transactions

Trade between different 5 different cryptos and convert to FIAT currency or vice versa

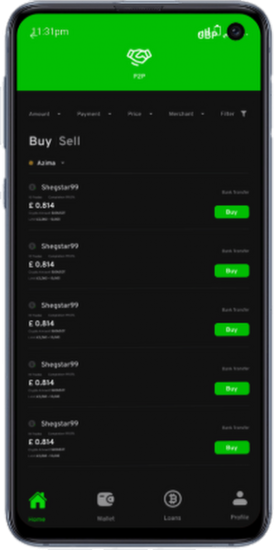

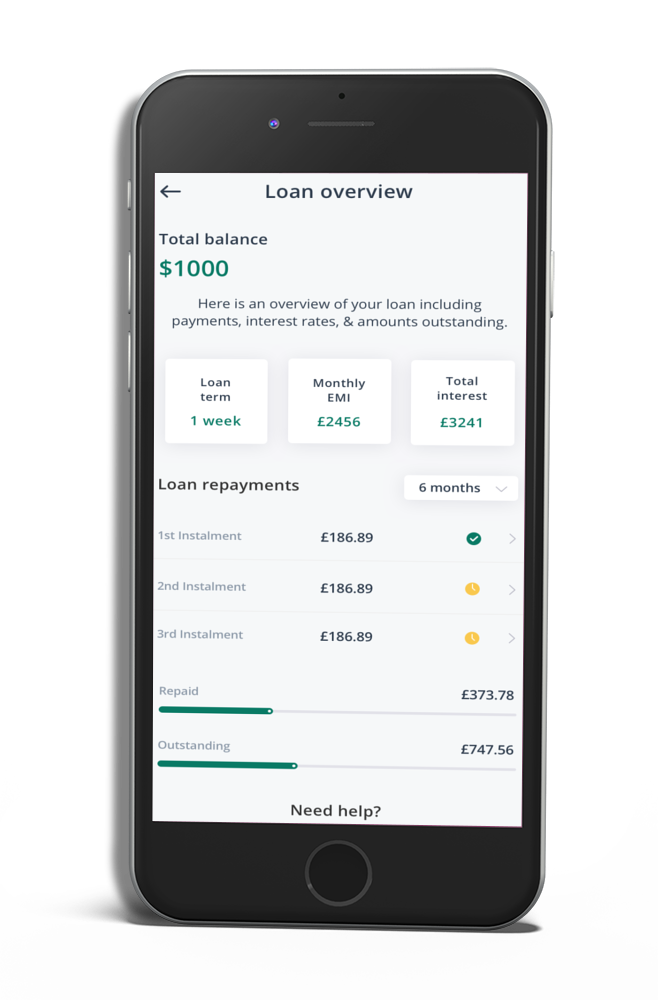

Crypto loans

Borrow from £100 to £1000 from a global network of lenders and borrowers, with low interest rates

Staking

Earn interest by funding crypto loans which provides liquidity to the market

Communituy Based

Join our global community of lenders and borrowers

Secure

We use the right technology to ensure your safety and security

Premium Features

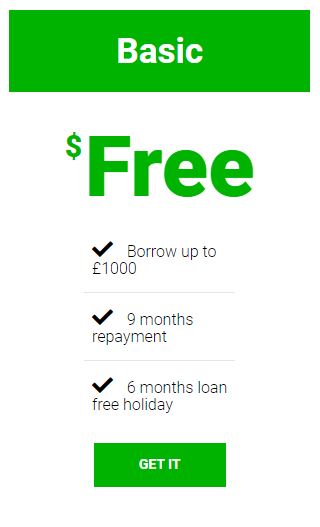

Access higher loans and lower interest rates by signing up for a premium account

What is P2P Trading?

Peer-to-Peer (P2P) trading is a process whereby people can exchange money between each other without the need for a centralized authority to facilitate the transactions. P2P trading works in 3 steps, 1) Place Order, 2) Pay the seller and 3) Get Your crypto. With P2P it’s users that send you the crypto rather than an exchange, Azima just acts as a facilitator and holds the funds in an escrow to ensure safety before its release.

Built on Cardano

Azima is a native token on the Cardano Blockchain, a decentralized 3rd generation POS platform

and home to the ADA cryptocurrency

Decentralised

Every ada holder holds a stake in the Cardano network, this helps to validate the Blockchain

3rd Gen Blockchain

Designed from the ground up by a team of top engineers and academic experts.

Inclusive

Committed to helping the marginalised and bring about positive global change.

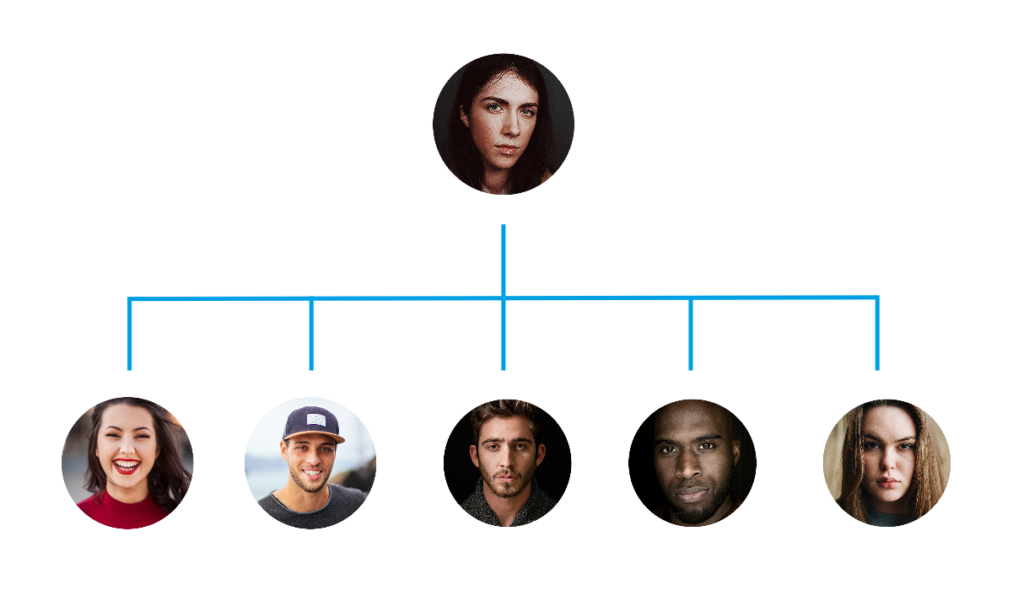

Crowdfunded Crypto Loans

Fund a loan and earn passive income from your contribution. The world’s first social lending platform!

I would like a loan for a Car Wedding course

Sure. I can help you with £300 £100 £200 £50

One loan : Many funders

Buy Azima Tokens

FAQ's?

This section will answer some basic questions about our lending app.

Azima is a fintech startup with a crypto token and decentralised application allowing users to conduct P2P trading between fiat currency and digital assets and access additional banking services. We want to revolutionise the banking industry helping to provide crypto based financial services to all areas of the world

Azima will support 4 cryptocurrencies including Bitcoin, ADA, Azima and USDT. ADA/Azima will be our main trading pair ensuring liquidity across the platform. We aim to support over 200+ currencies and FIAT withdrawals to national banks.

A P2P transaction is simply an order placed between two users. You can either buy crypto or sell crypto. Let’s say you want to buy USDT with GBP. You choose from a list of sellers and make a payment. Once the seller has verified receipt of the payment the crypto amount is released to your wallet. The same would work for sell orders but in reverse.

No. Non-custodial wallets, give the owner full responsibility over their wallet via private keys, meaning that an exchange or company can’t control their access. Azima wallets need to be custodial so that we can facilitate the safe exchange of trades and loans between users. If we were non-custodial bad actors could take advantage and your funds would be less safe. We are still decentralised because, just like a blockchain is reliant on multiple nodes to keep it running, we are reliant on many users to complete trades.

Azima will register with the relevant crypto regulatatory bodies and insurance providers giving you an extra piece of mind. If a customer’s loan is liquidated the crypto collateral is taken and distributed to the lenders avoiding any third parties and lengthy disputes. If any outstanding monies are owed, they will be taken on by us and the lender given the chance to settle the debt.

The maximum loan amount you can borrow with Azima is £1000, however this is based on a LTV ratio (see About Page). Azima is designed for small, short term emergency borrowing, from 100 to £1000. Once we are more established we will introduce a premium loan service up to £2000.

Once the seller or buyer has confirmed your payment, they will release the funds and it will be available in your Azima wallet as tokens. You will then have the option to convert it in the app or withdraw to an external wallet.

Crypto loans work slightly different to normal loans, because you are required to deposit a collateral, which works like a deposit. You can only borrow up to a percentage of your collateral typically 67%. If your loan reaches liquidation then your deposit will be taken from your holding wallet and distributed back to the lenders.

Pricing

Assosciated Organisations

Ethical Lending

One of our core values is ‘ethical lending.’ Borrowing money is a normal part of society and you may need extra money for any number of reasons. Our aim is to create a platform for hard working people who need an extra source of cash to borrow money that doesn’t trap them in a vicious cycle of debt like payday loan providers.