About Azima

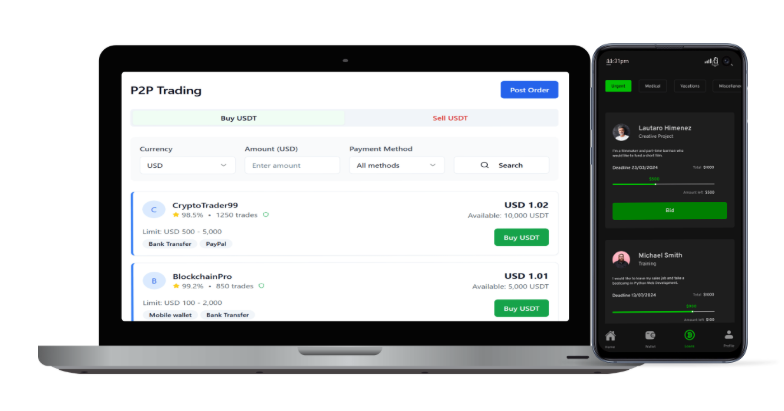

The Azima P2P Exchange

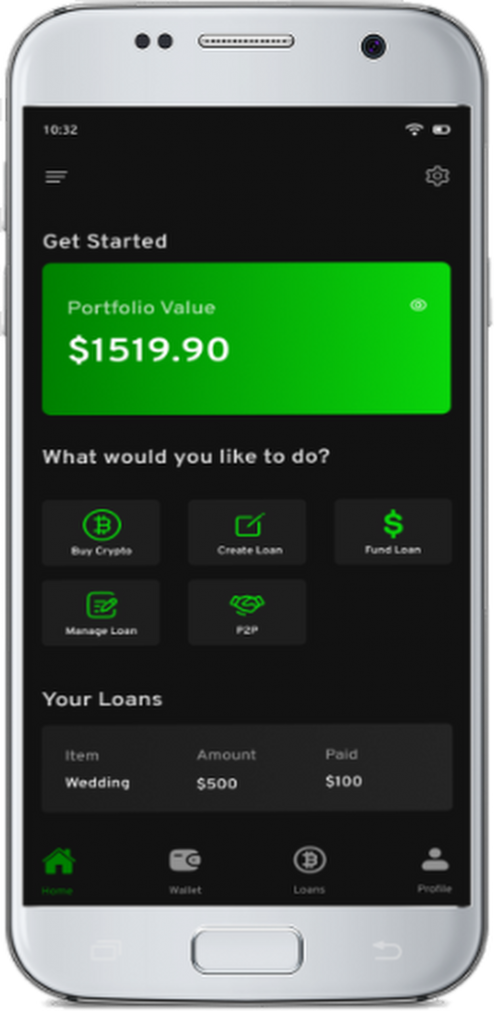

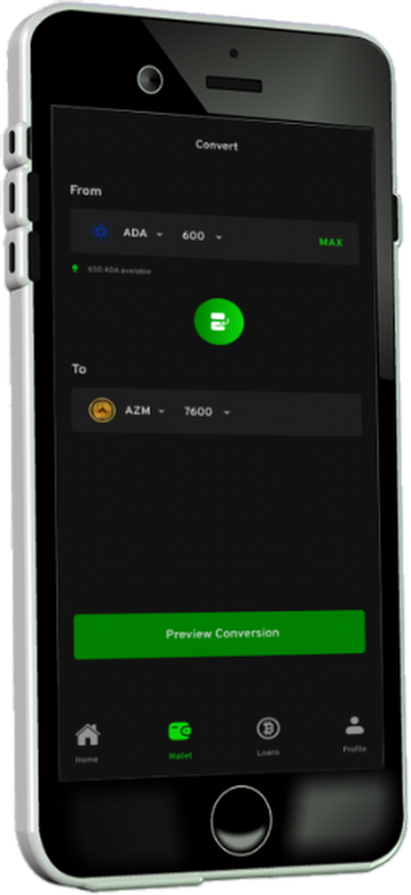

The Azima d’app serves three main products 1) buying Azima tokens (AZM) and other coins 2) buying and selling crypto with our P2P exchange and 3) taking or funding loans with our crowdfunded crypto loans service. The Azima token powers the Azima d’app giving it utility and a long term use case. The Azima d’app is just one of the products in the Azima ecoysystem including a liquidity pool, lending protocol, smart contracts, wallet service and much much more. By interacting with our products and services, users across the globe have extra banking services, can earn passive income and create a new financial ecosystem that serves the people.

The Azima Ecosystem

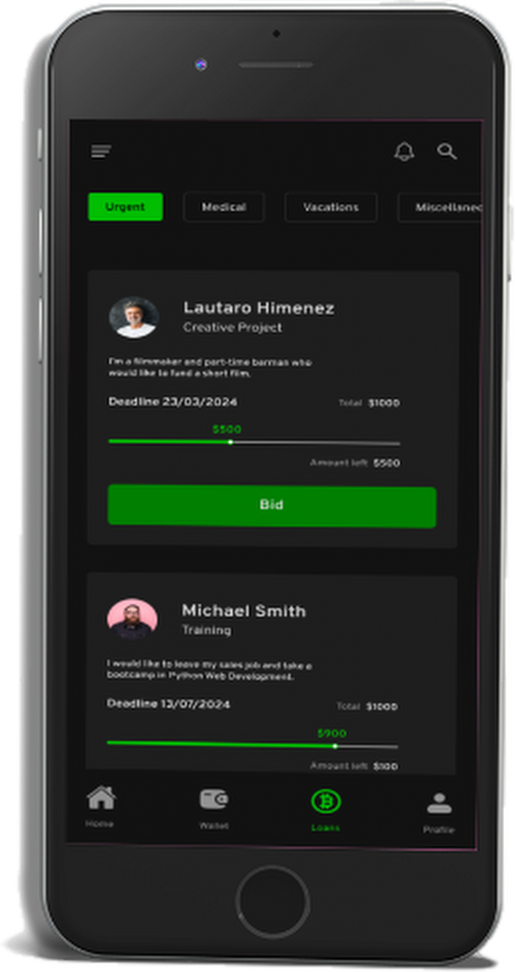

Our native token (Azima) is used in our d’app and powers the Azima ecoystem. P2P trading is the core feature of our d’app, Azima just facilitate the process. Our lending model is set up to enroll a borrower’s collateral is into our public stakepool, this helps to run the Cardano blockchain and collect rewards. The rewards are accrued during the duration of the loan and re-distrubuted back to the lenders every week until the loan is finalised, earning them passive income as a reward for funding a loan. Meanwhile our P2P traders can earn profit by completing trades and enjoy special benefits and promotions. A working and profitable business model is essential to the longevity and success of the project so it essential that everyone benefits at every stage in the process.

P2P Trades

Buy/Sell crypto in exchange for FIAT currency from a user instead of an exchange

Crypto Loans

Borrow money in crypto on our social crowdfunding d’app

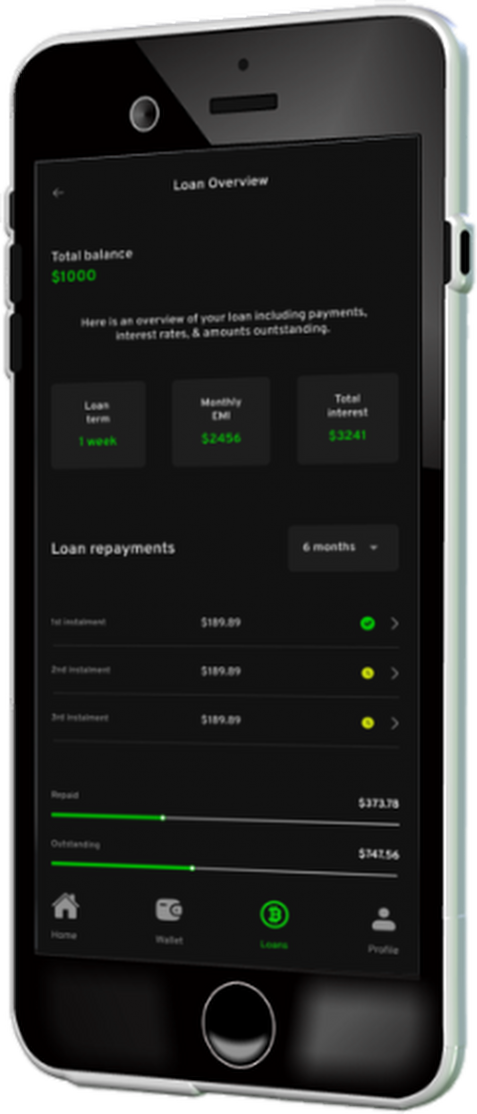

App Screens

See our d’app in action, with these selected screenshots from our protoype, developed with Hyper Apps.

The Team

Segun Magbagbeola

Founder & CTO

Segun is a professional DevOps engineer and serial founder. His core skills are in technical writing, project management and business growth.

Teresia

Wamalwa

Co-founder

Teri has 2 years of professional P2P trading experience on Binance specialising in the USDT/KES trading pair. She has completed over 1200 trades and is rated 4.6/5.

Patrick Wasawo

Ambassador

Patrick is an independent and instinctive thinker. He is an active crypto trader and blogger and promotes crypto events in East Africa.

Roadmap

Phase 1 (Q2-Q3 2021)

Hyper Development Programme

1st Iteration of project model

Clickable Prototype

Phase 2 (Q1-Q3 2023)

Website

Minted (AZM) Tokens

Whitepaper

2nd iteration of Project Model

Phase 3 (Q3-Q4 2024)

Pre-Token Sale

IDO

3rd iteration of Project Model

MVP Development (Beta)

Phase 4 (Q1-Q2 2025)

Exchanges Submissions

Public Sale

Public Stake Pool

D’app Development

Phase 5 (Q4 2025)

Project Launch

App Store Releases

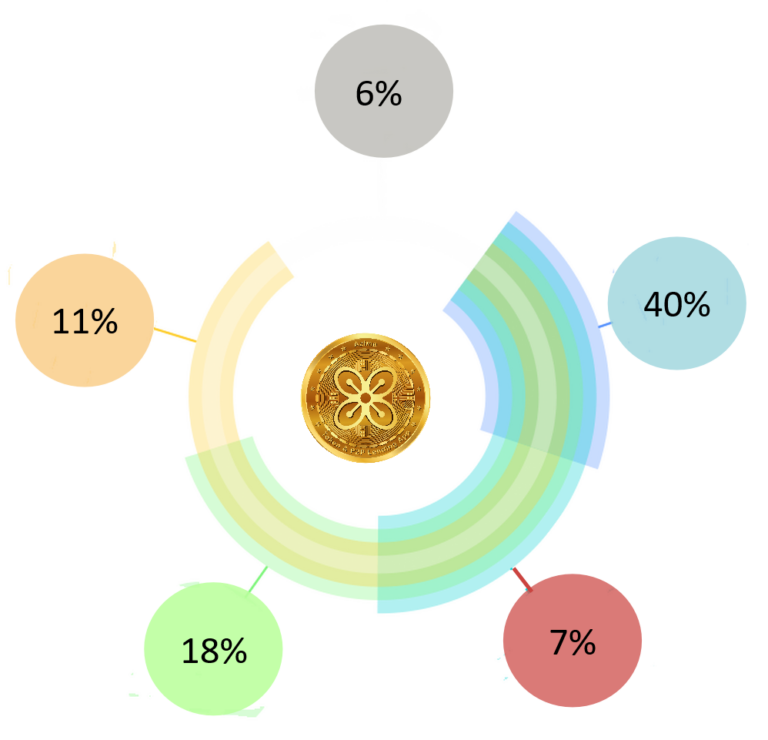

Tokenomics

The pie chart below shows our token distribution, project utility, supply and reward structure.

6% Pre-Sale

40% Public

7% DEX’s

18% Staking Rewards

18% Founder & Team

11% Liquidity

Once a loan is approved, the lenders funds and the borrowers collateral are sent directly to a staking pool. The lender earns rewards paid out every epoch (five days) and the borrowers collateral is locked but released upon full loan repayment with added on staking rewards.